Here’s What the Data Says

With home prices remaining high and talk of a looming recession, many are wondering: is the real estate market heading for a crash in 2025?

It’s a fair question, especially for those who lived through the 2008 housing crisis. The fear of history repeating itself is real. However, a closer look at current data, market fundamentals, and historical trends reveals that a housing crash next year is unlikely. Here’s why.

Not Every Recession Equals a Housing Crash

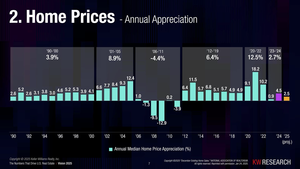

Over the past 20 years, the U.S. has experienced two official recessions. The first, from 2006 to 2009, was driven by the real estate market itself, fueled by subprime lending, loose regulations, and unsustainable home purchases. Home prices dropped roughly 13% during this period — a significant decline caused directly by a housing bubble.

However, other recessions have told a different story. For example, during the brief 2020 recession triggered by the COVID-19 pandemic, housing prices remained stable and even rose in many markets. Historically, recessions that are not caused by housing factors do not typically result in steep home price declines. The cause of the recession plays a critical role in how the housing market reacts.

Supply and Demand: Inventory Remains Critically Low

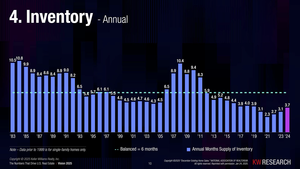

A key factor supporting current home prices is inventory — or rather, the lack of it. Despite a modest increase in inventory over the past 12 months, the housing market is still experiencing historically low levels of available homes. When supply is limited and demand persists, prices tend to remain stable.

Even with higher interest rates and economic uncertainty, the basic need for housing remains. Population growth, particularly from millennials — now the largest group of homebuyers — and Gen Z entering the market ensures continued demand. This demographic pressure supports price stability.

Lending Standards and Homeowner Equity are Strong

Post-2008, lending standards have tightened considerably. Today’s buyers are more financially qualified, and most have significant equity in their homes. This makes a wave of foreclosures, like the one seen during the last crash, far less likely.

Additionally, over 60% of homeowners have mortgage rates below 4%. These homeowners are not in a hurry to sell, which further limits inventory and bolsters home values.

Key Takeaways: A Crash is Unlikely

Let’s recap the major factors:

- Historically low inventory is supporting prices.

- Buyer demand remains steady, driven by demographic trends.

- Tight lending standards ensure homeowners are more financially secure.

- High levels of homeowner equity reduce the risk of mass foreclosures.

All signs point to a market fundamentally different from that of 2008. While moderate shifts or slowdowns may occur — especially if broader economic conditions fluctuate — a significant housing crash in 2025 would require a drastic change in supply and demand dynamics.

Focus on Long-Term Goals, Not Market Timing

Real estate has historically been one of the most reliable ways to build wealth over time. Instead of trying to predict the perfect moment to buy or sell, it’s often more effective to align decisions with personal goals and timelines.

While it’s always wise to stay informed and cautious, current data does not support the prediction of a housing crash in 2025.