Why More Homeowners Are Moving in 2025 — Even with Low Mortgage Rates

For many homeowners who locked in ultra-low mortgage rates during the pandemic, the thought of moving might seem unthinkable. After all, why give up a 2% or 3% rate for something in the 6% range? Yet, more and more people are choosing to make a move in 2025 despite this financial trade-off.

The answer lies beyond the numbers: life doesn’t pause for mortgage rates.

Life Changes Are Driving Moves

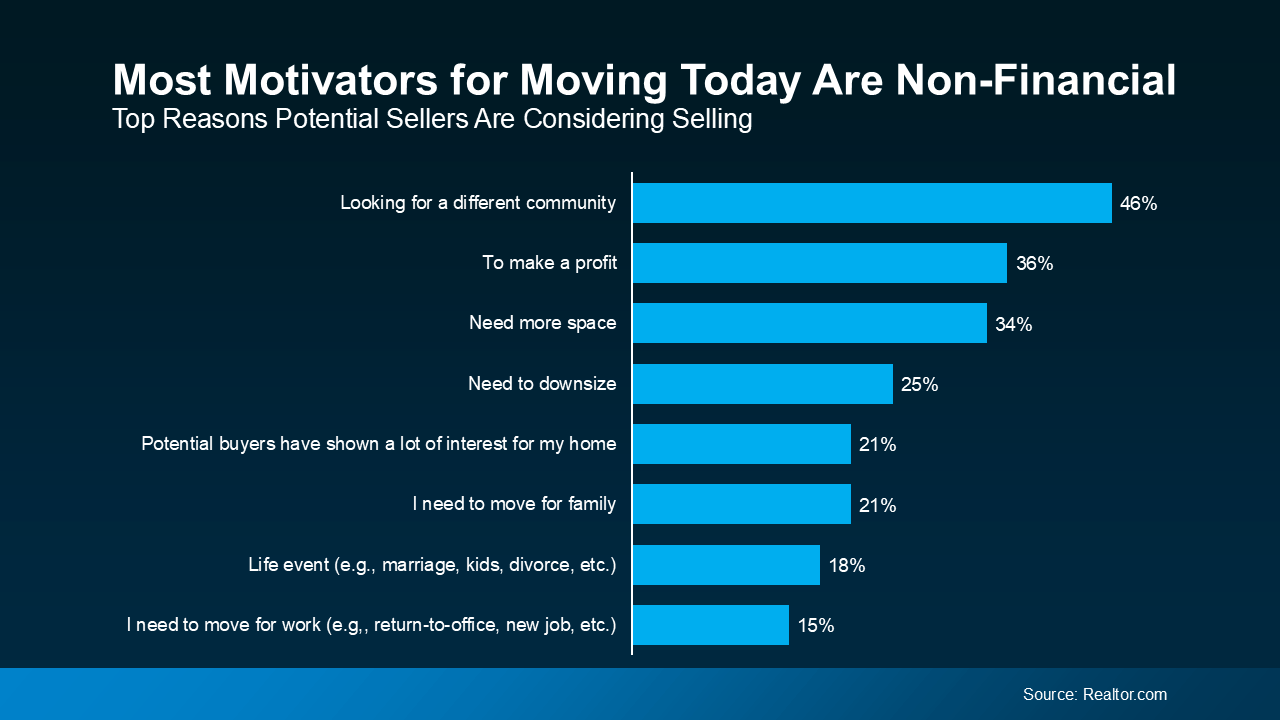

While a low mortgage rate can feel like a golden ticket, it doesn’t solve evolving lifestyle needs. Recent data shows that nearly 79% of homeowners considering a sale aren’t driven by market timing — they’re moving because their life circumstances have changed.

Key reasons include:

Seeking a different community (46%)

Needing more space (34%)

Downsizing (25%)

Moving closer to family (21%)

Job relocation (15%)

These shifts can happen for many reasons — welcoming a new baby, adjusting to multi-generational living, supporting aging parents, or simply wanting to simplify life after kids have moved out. The home that was perfect just a few years ago might now feel too cramped, too large, or no longer in the right location.

Mortgage Rates: The Bigger Picture

Though many homeowners locked in historically low rates during the pandemic, the share of people holding onto these ultra-low rates is declining. In May 2024, around 29% of homeowners had rates below 3%. By May 2025, that number dropped to just under 21%. Meanwhile, homeowners with rates above 6% increased from 12% to 18%.

This trend reveals an important point: homeowners are willing to accept higher rates if it means finding a home that better matches their current needs and lifestyle.

The Myth of "Waiting for Rates to Drop"

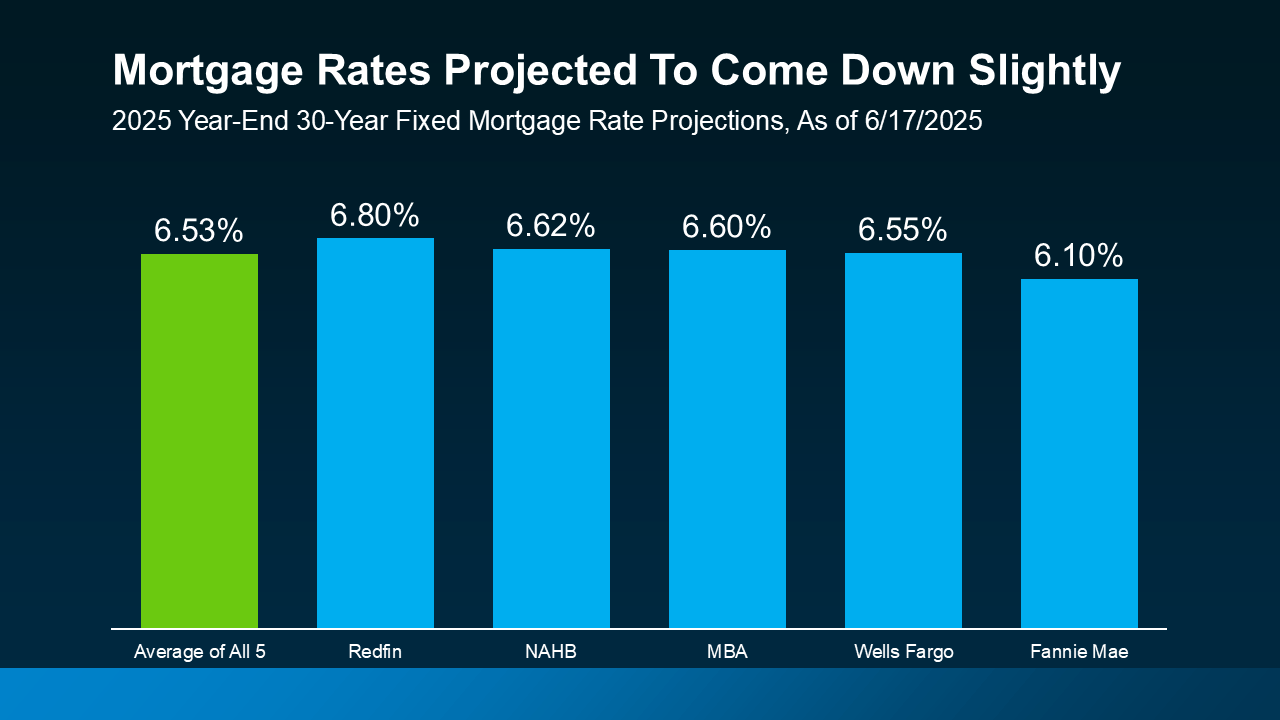

Many people wonder if waiting will bring back 3% rates. Forecasts suggest otherwise. By the end of 2025, average mortgage rates are expected to be around 6.53%. While this may be slightly lower than today, it’s far from the historically low levels seen in 2020 and 2021.

Waiting for rates to drop significantly could mean staying in a home that no longer fits for another year or more — potentially delaying important life changes and compromising day-to-day comfort.

The Bottom Line

Choosing when to move isn’t just a financial decision — it’s a deeply personal one that should reflect current lifestyle needs and future goals.

For many homeowners, the decision to move now is driven by the need for a home that better supports their life today, rather than holding onto a rate that no longer serves them.

Anyone feeling torn between their current low rate and a desire for a better living situation isn’t alone. Many are finding that the benefits of moving — more space, a better location, or a layout that suits a new chapter of life — far outweigh the costs of a higher mortgage rate.

In the end, it’s not just about numbers; it’s about moving toward a home that truly fits.

Join Jackie and Randolf on this weeks Market Update video for the full scoop!