History Shows the Housing Market Always Recovers

The housing market has always moved in cycles. Periods of rapid growth are often followed by slowdowns, leaving buyers and sellers wondering if recovery will ever come. While today’s market may feel uncertain, history consistently proves that housing always rebounds after a drought.

Lessons From the Past

Slowdowns in the housing market are nothing new. Several notable examples show how resilience is built into the system:

1980s: When mortgage rates soared above 18%, buyers pulled back dramatically. Sales slowed for years, but as rates declined, activity surged and the market regained stability.

2008: The Great Financial Crisis marked one of the toughest housing downturns in history. Home values dropped, transactions froze, and consumer confidence plummeted. Yet, once the economy recovered, home sales and prices followed suit.

2020: At the onset of the pandemic, real estate transactions halted almost overnight. The market paused as buyers and sellers adjusted to uncertainty. But the rebound was faster than anyone expected, with a surge in demand as soon as restrictions lifted.

Each of these moments illustrates a key truth: downturns may be challenging in the moment, but none of them lasted forever.

Understanding Today’s Market

Over the past two years, home sales have slowed largely due to affordability challenges. Mortgage rates rose at a record pace while home prices remained elevated, making it harder for many buyers to enter the market. In response, some homeowners have chosen to delay selling, with many even pulling listings after not receiving offers that met expectations.

Although this situation can feel discouraging, it is not a permanent state. Instead, it is part of the same cycle the housing market has experienced for decades.

Why the Outlook Is Positive

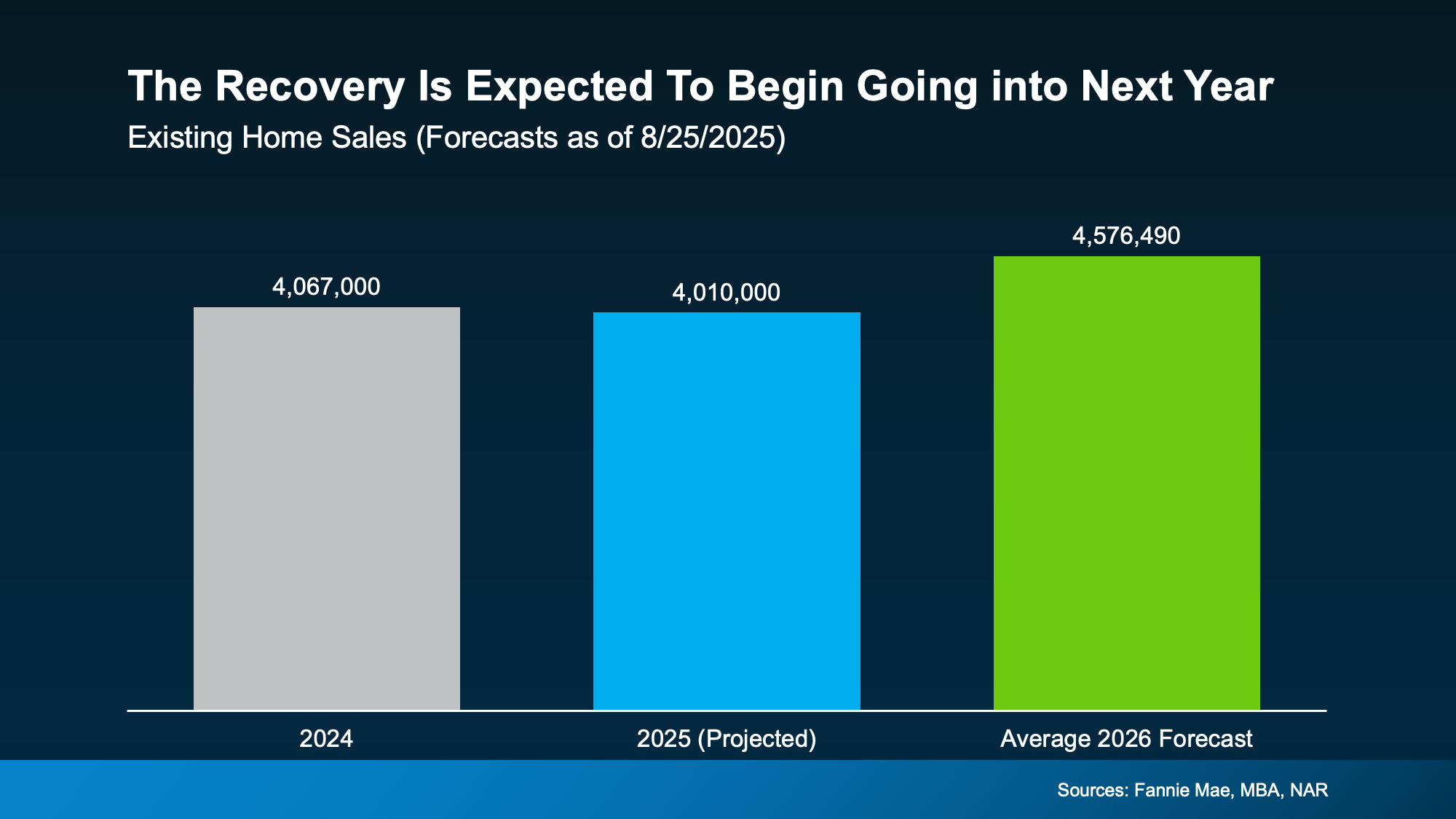

Leading industry forecasters, including Fannie Mae, the Mortgage Bankers Association, and the National Association of Realtors, expect improvement in the coming years. Projections show home sales could rise to approximately 4.6 million by 2026—up significantly from the slower pace seen recently.

One of the key drivers behind this outlook is the expectation that mortgage rates will moderate. As affordability improves, sidelined buyers will be able to re-enter the market, creating renewed momentum. This increased demand will naturally support both sales and home values, driving the next recovery cycle.

What It Means for Homeowners and Buyers

For those who feel stuck in today’s market, it is important to remember the bigger picture. Housing slowdowns are temporary, and history demonstrates that recoveries always follow. The most successful buyers and sellers are the ones who prepare during quiet times so they can act quickly once activity begins to pick up again.

Bottom Line

The housing market has weathered many storms over the decades, from record-high interest rates to financial crises and global disruptions. Each time, recovery has followed. Today’s challenges are no different. While the slowdown has created frustration for some, it is part of a cycle that always shifts back toward growth.

Staying informed, watching for the signs of change, and preparing a strategy now will ensure the best possible position when the next wave of opportunity arrives.

Join Jackie and Michele in this weeks Market Update Video: