The question of whether the real estate market is on the brink of a crash has been a recurring topic of discussion, particularly in light of economic uncertainties and memories of the 2008 financial crisis. However, a closer look at key indicators suggests that the current market is far from a repeat of 2008. Here’s why.

Inventory Levels

One of the most significant indicators of a potential market crash is inventory levels. In 2008, the housing market was flooded with inventory, reaching a peak of 10.4 months’ worth of supply. This glut of homes on the market was a major factor in the subsequent crash. Today, the situation is markedly different. Current inventory levels are at a much more manageable 4.1 months. This is a clear sign that the market is more balanced, with supply and demand being more closely aligned.

The advancement of technology has also played a role in maintaining this balance. Tools that provide real-time data and analytics allow buyers, sellers, and agents to make informed decisions more quickly, preventing the kind of oversupply that contributed to the 2008 crash.

Controlled Home Building

Another critical difference between now and 2008 is the approach to home building. In the years leading up to the last crash, builders were putting up homes at a rapid pace, with about 1.6 million homes being built per year. This overbuilding led to a surplus of homes that far outpaced demand.

Today, builders are exercising more caution. The current rate of new construction is around 1 million homes per year, a significant decrease from the pre-2008 levels. Builders have learned from past mistakes and are now phasing construction more carefully. Many new communities are being developed in stages, with builders ensuring that demand is met before moving on to the next phase of construction. This approach is helping to prevent the kind of oversupply that was so damaging in 2008.

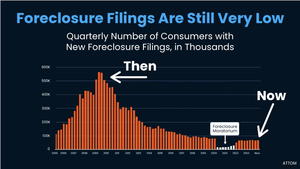

Foreclosure Rates

Foreclosure rates provide another stark contrast between the current market and that of 2008. During the crash, foreclosure rates soared, with over 500,000,000 homes going into foreclosure. This flood of foreclosed homes further depressed the market and contributed to the downward spiral.

In contrast, today’s foreclosure rates are much lower, standing at about 100,000,000. This significant reduction indicates that homeowners are generally in a better financial position, and fewer are defaulting on their mortgages. The lower foreclosure rates contribute to the overall health of the market, keeping home prices stable and preventing the kind of cascading effects seen in 2008.

A Balanced, Robust Market

When considering these factors—inventory levels, controlled home building, and low foreclosure rates—it becomes clear that the current real estate market is not heading towards a crash. Instead, the market is in a much healthier and more balanced state than it was in 2008.

For those in the market to buy a home, these conditions present a favorable environment. The market is robust yet balanced, offering opportunities without the risk of an imminent downturn. While it’s always important to approach any real estate transaction with careful consideration and due diligence, the current market fundamentals suggest stability rather than a looming crisis.

Watch our latest Monday Market Update for more on the subject: