The housing market is influenced by various economic factors, and among the most significant are mortgage rates. As someone interested in buying or selling a home, understanding the trends in mortgage rates can help in making informed decisions. Recently, inflation has been on a downward trend, raising questions about its impact on mortgage rates. Here, we explore the connection between inflation and mortgage rates, and what the current economic indicators suggest for the future.

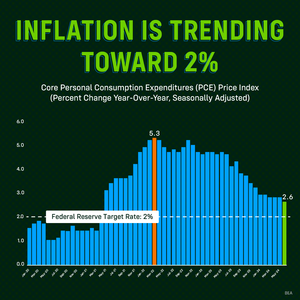

Inflation Rates

Inflation is a critical factor that the Federal Reserve monitors closely. In March 2022, the inflation rate was around 5.3%. Over time, it has gradually decreased, and as of now, it stands at approximately 2.6%. The Federal Reserve aims for a target inflation rate of 2%. As inflation approaches this target, it is expected that the federal funds rate, which influences mortgage rates, will also decrease. This reduction in the federal funds rate typically leads to lower mortgage rates, making borrowing cheaper for homebuyers.

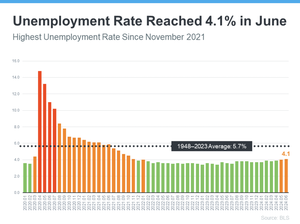

Unemployment Rates

Unemployment Rates

Another crucial factor is the unemployment rate. The Federal Reserve considers a rising unemployment rate as an indicator of reduced economic spending, which helps to control inflation. While it may seem counterintuitive, higher unemployment can lead to lower inflation, prompting the Fed to lower the federal funds rate. This, in turn, can result in lower mortgage rates. The current trends in unemployment rates will significantly influence the Fed’s decisions in the coming months.

Job Growth

Job growth is another indicator that the Federal Reserve evaluates. Although job creation has been robust over the past year, the Fed seeks a slowdown in job growth before making any changes to the federal funds rate. A slower rate of job creation suggests that the economy is cooling down, which can help control inflation. If job growth continues to slow, it increases the likelihood of the Fed reducing the federal funds rate, which would likely lead to lower mortgage rates.

What to Expect in the Coming Months

Based on current economic indicators, experts suggest there is a strong probability that the Federal Reserve will lower the federal funds rate if the trends in inflation, unemployment, and job growth continue as expected. Specifically, there is a 96.1% chance that the Fed will reduce the rate by September if these conditions are met; according to the CME FedWatch Tool. This anticipated action could result in lower mortgage rates, benefiting potential homebuyers and those looking to refinance.

Bottom Line

While it is useful to be aware of these economic trends, it is essential to remember that trying to time the market perfectly is often not advisable. Economic reports, world events, and other factors can cause unexpected changes. Therefore, making real estate decisions should be based on personal circumstances and needs rather than solely on predicted market conditions.

In conclusion, the lowering inflation rate is a positive sign for those hoping for lower mortgage rates. However, the final outcome will depend on various factors, including unemployment rates and job growth. Staying informed and consulting with real estate experts can help navigate these changes effectively.

For those considering buying or selling a home, now is a good time to assess your situation and consult with professionals to make the best decision for your needs.