Why the Five-Year Rule Matters More Than Year-Over-Year Home Price Changes

In a market where headlines are quick to highlight short-term dips in home prices, it’s easy for homeowners and buyers to feel uncertain. But perspective is key—especially in real estate. That’s where the Five-Year Rule comes in.

Short-Term Fluctuations vs. Long-Term Growth

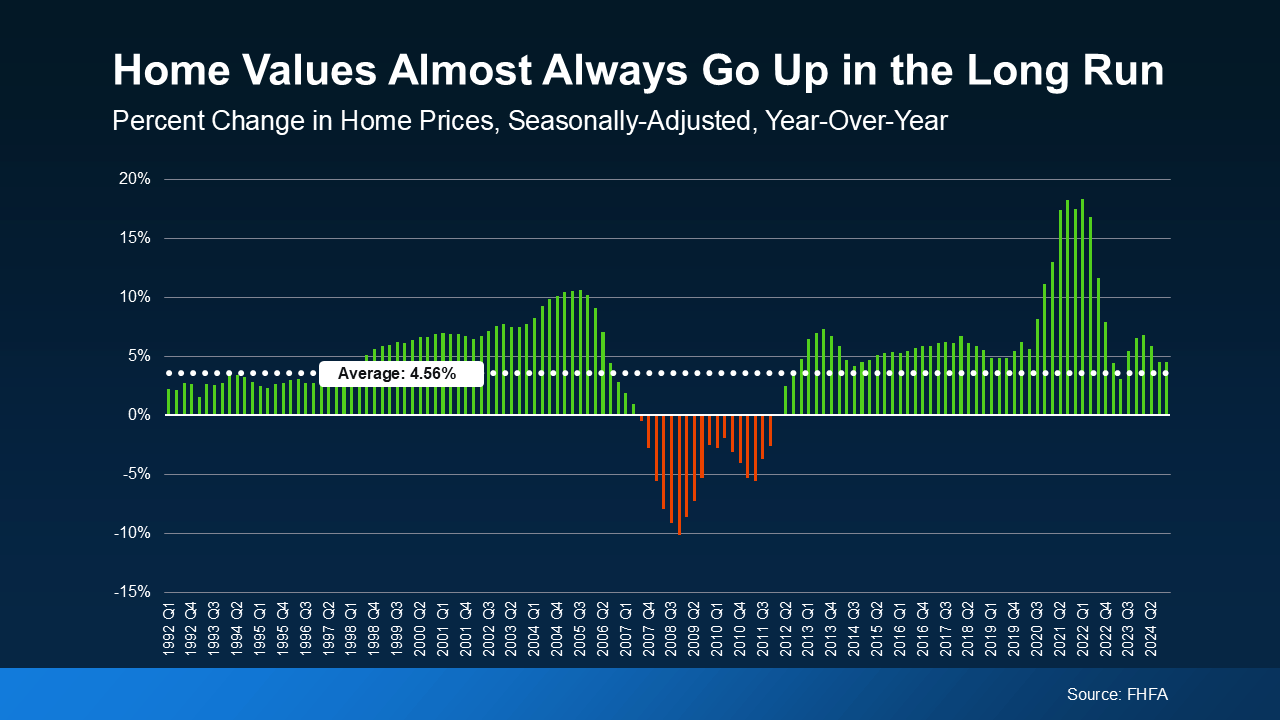

While some cities may be experiencing slight declines in year-over-year appreciation, the broader historical trend shows a steady upward trajectory for home values. Home prices are known to fluctuate seasonally and economically, but over time, they almost always rise. Even with the occasional dip, the overall direction has consistently been positive.

A perfect example is the graph showing the seasonally adjusted year-over-year change in home prices. While minor downturns are visible, the long-term trajectory remains strong. It’s also worth noting that past market crashes—like the 2008 housing crisis—were triggered by factors that simply aren’t present today. Lending standards are now more stringent, homeowners have higher equity, and there’s no oversupply of homes on the market.

What Is the Five-Year Rule?

The Five-Year Rule is a simple but powerful principle in real estate: if you plan to stay in your home for five years or more, short-term market fluctuations become largely irrelevant.

Here’s why it works:

Over a five-year span, most homeowners see a net increase in property value—even if they purchased during a slower or down market.

Real estate is a long-term investment. It’s not about timing the market perfectly; it’s about time in the market.

The quality-of-life benefits—like a shorter commute, a better school district, or a more peaceful environment—can often outweigh short-term financial considerations.

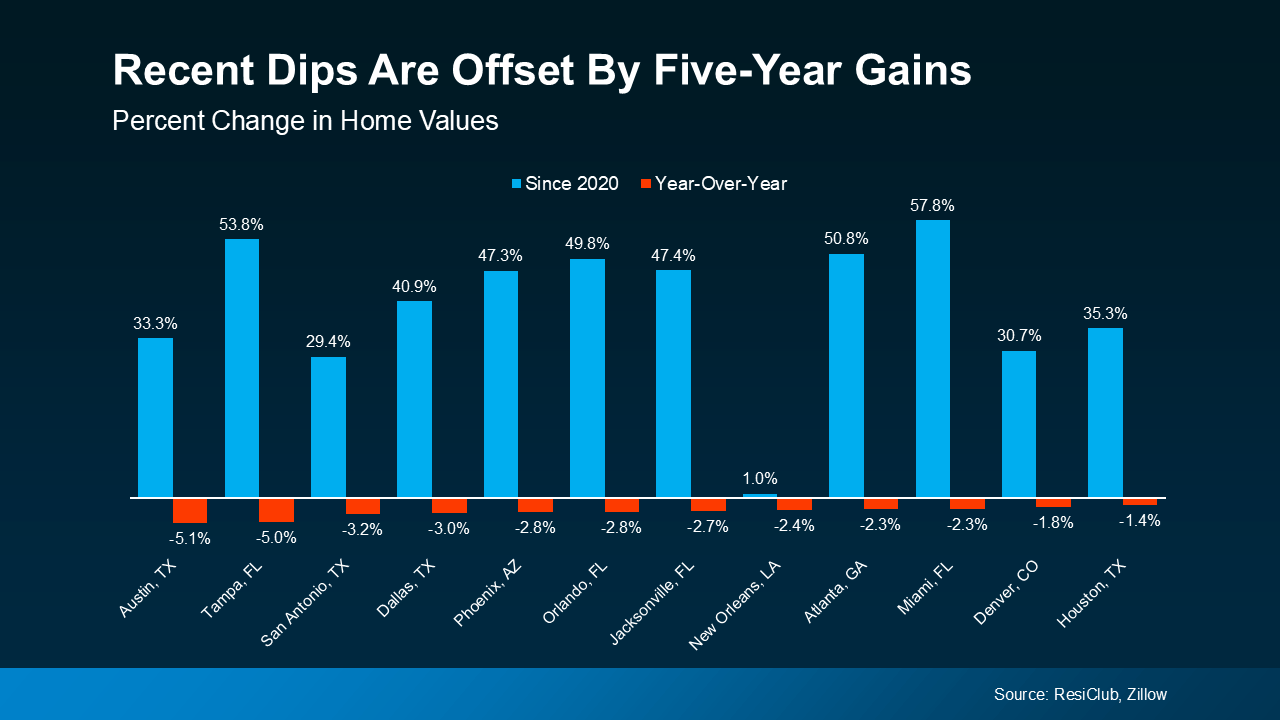

Even in major metro areas that have seen modest dips recently, five-year appreciation remains strong. In fact, over the last five years, home prices across the U.S. have surged by approximately 55%. This growth has been remarkably consistent—even in markets currently labeled as “cooling.”

What About Portland?

Although Portland may not have been featured in some national graphs, the same five-year trend applies locally. Portland’s housing market, like much of the country, has shown resilience and long-term growth, even if current appreciation rates are more modest compared to the recent past.

Looking Ahead

Most experts project that home values will continue to rise in the coming years, albeit at a more normal pace of 3–5% annually. That’s a healthy rate of appreciation—especially when combined with:

Equity gains from mortgage payments

Tax advantages of homeownership

Lifestyle improvements from owning a home that suits your needs

The Bottom Line

Year-over-year stats may fluctuate, but homeownership is still one of the most reliable paths to long-term wealth. If you’re buying or selling, zoom out and take the long view. Real estate rewards those who stay invested—not just financially, but in their lifestyle and peace of mind.

So before you panic over a headline or a temporary market shift, remember the Five-Year Rule. It’s not just smart advice—it’s backed by decades of data and real-life homeowner experience.

John John and Michele on this week's Market Update Video: