Why More Portland Homeowners Are Giving Up Their Low Mortgage Rate in 2025

For the past few years, Portland-area homeowners with 2–3% mortgage rates have been holding onto their homes longer than ever before. That ultra-low rate became a financial trophy — and for good reason. It saved hundreds per month and made homes purchased between 2020–2022 incredibly affordable.

But in 2025, something important is happening across the Portland-Vancouver metro area:

More homeowners are beginning to move, even if it means trading in that low rate.

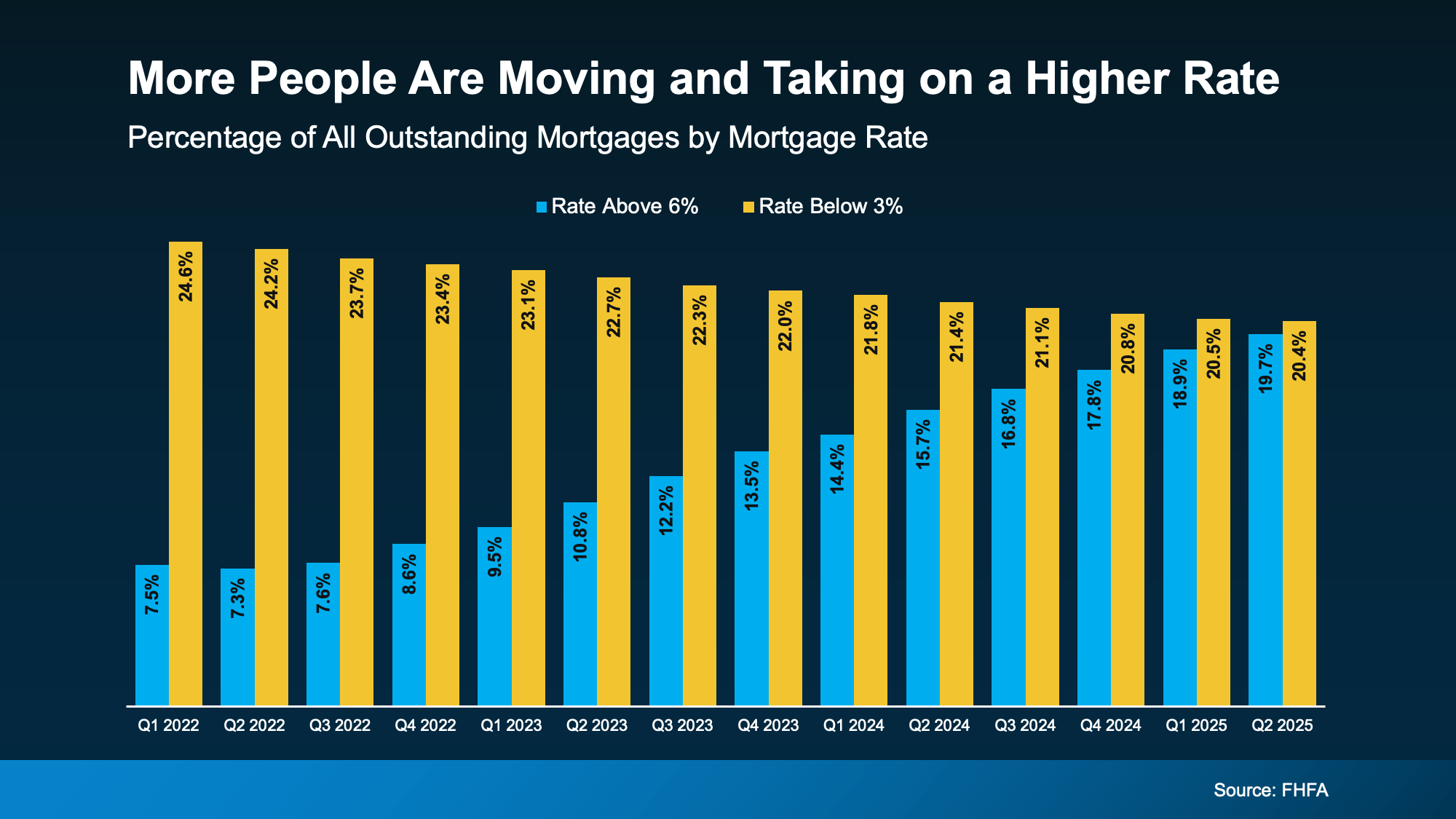

New data from the Federal Housing Finance Agency (FHFA) shows that the number of sub-3% mortgages is declining, while the share of homeowners taking on 6%+ rates has reached a 10-year high. This shift is happening nationwide, but it’s especially noticeable in markets like Portland where lifestyle, job growth, and housing needs are rapidly evolving.

And it’s reshaping the local real estate landscape.

Understanding the Trend: Why Portland Homeowners Are Moving Even With Higher Rates

1. Portland’s housing needs are changing — and many homes bought during the pandemic no longer fit

In the pandemic boom, many buyers bought:

smaller starter homes in SE Portland or outer NE neighborhoods

townhomes in Hillsboro or Beaverton

condos in Northwest Portland for easy urban access

homes that worked during remote work but now feel cramped

Fast-forward to 2025, and Portlanders are facing new realities:

Returning to hybrid work and needing a better commute

Expanding families that need more bedrooms

Desire for larger yards or more privacy

Choosing to live closer to family in SW Portland, Happy Valley, or Vancouver

Downsizing into easier-to-maintain spaces as kids move out

A low rate simply cannot solve a lifestyle mismatch — especially in a city where neighborhoods offer very different lifestyles.

This explains why more Portland homeowners feel the need to move even if today’s rates are higher than what they currently have.

2. Portland's job market is pulling people into new neighborhoods

Greater Portland has seen shifts in where people work:

Tech growth along the Silicon Forest (Intel, Nike, Tektronix)

Increasing employment near South Waterfront

Suburban job corridors in Beaverton, Tigard, and Hillsboro

Vancouver and Camas seeing strong employer expansion

As job centers move, commute priorities follow.

Many homeowners who bought in 2020–2021 now have a completely different daily life. A long commute on I-5 or Highway 26 isn’t worth preserving a low rate for many residents — especially those balancing childcare, school drop-offs, or hybrid schedules.

3. Migration trends are reshaping demand in Portland

Portland continues to experience:

• Inbound migration from California, Seattle, and the East Coast

New buyers bring strong purchasing power — and they’re willing to take on today’s mortgage rates because they want to relocate now.

• Local movement from Multnomah County into Washington County and Clark County

Many long-time Portlanders are:

moving for more space

lowering property taxes

seeking newer construction

moving closer to schools or extended family

This churn in the marketplace means more homeowners are selling — even with a low rate — because life changes outweigh the cost of moving.

The FHFA Graph

While this chart reflects U.S. data, it directly aligns with Portland market behavior:

Portland has one of the highest shares of sub-4% mortgages on the West Coast, so the lock-in effect hit our region harder.

Yet Portland also has one of the strongest lifestyle-driven relocation markets — people often buy here because of jobs, nature, schools, or walkability.

As a result, more Portland homeowners are crossing into 6%+ rates because they simply can’t delay life transitions any longer.

From 2022 to 2025, the share of mortgages above 6% has increased from around 7–8% to nearly 20%, reflecting a meaningful shift in seller behavior.

4. Portland’s home equity gains make moving more realistic

Homeowners across the city — from Sellwood to Cedar Mill to Alberta Arts — have seen significant appreciation since 2019.

According to FHFA, Oregon home values have risen roughly 40% in the past five years, depending on the neighborhood.

That equity can:

offset today’s higher rates

increase down payment strength

reduce monthly payments

give homeowners more choices in competitive neighborhoods

For many, equity is the tool that finally makes moving possible.

5. Portland inventory remains historically low — so sellers still have leverage

While higher rates have slowed some buyer activity, Portland inventory remains well below normal.

This is especially true in:

Inner Southeast (Hawthorne, Richmond, Woodstock)

Bethany / Cedar Mill

North Portland (Kenton, Arbor Lodge)

Vancouver East and Camas

Low inventory supports strong demand, which gives sellers more power than they might expect.

This is one reason many Portland homeowners are choosing to move now:

You may give up your low rate, but you gain strong selling conditions at the same time.

6. Rates have come down from their peak — and are expected to ease further

Portland buyers saw rates hit 7.5–8% between 2023–2024.

Today?

Rates are generally lower, and industry forecasts (Fannie Mae, MBA) expect gradual softening into 2026.

Buyers and sellers in the metro area are becoming more comfortable with the new normal, especially when the home they want offers the lifestyle they need.

What This Means for Portland-Area Homeowners in 2025

If your home no longer fits your life, you’re not alone. Homeowners throughout Portland, Vancouver, Beaverton, and Hillsboro are making the same decision:

Life needs come first — not interest rates.

People are choosing:

shorter commutes

better school districts

more space

less maintenance

proximity to family

more walkable neighborhoods

or simply a fresh start

And many realize that staying put for a rate is costing more in lifestyle value than it’s saving financially.

Bottom Line for Portland Homeowners

More homeowners across the Portland metro are choosing to move — not because they want to pay more, but because life has changed.

Rates have come down from their peak, equity is strong, and forecasted improvements in 2026 make the transition more manageable. If your home no longer fits your life or your future goals, now may be the time to explore what moving could make possible.