As we approach the end of 2023, we thought it was the perfect time to take a closer look at the predictions we made earlier this year and see how they have panned out in the current real estate market. We’ve always emphasized that while we don’t have a crystal ball, we aim to provide informed insights. So, let’s dive into the key aspects of the market we predicted and compare them to the actual outcomes.

Interest Rates:

At the beginning of the year, we anticipated interest rates would finish 2023 in the high sixes. As we evaluate our prediction today, we find that we were pretty much on the mark – interest rates are currently in the mid-sixes. We deliberately took a slightly more conservative stance, given the varying opinions in the market about rates potentially dipping into the fives. This steady interest rate environment has been a positive factor for prospective homebuyers, ensuring continued affordability in the market.

Home Prices:

Our prediction for home prices in 2023 was a modest 0.5% increase. However, the real estate market threw us a curveball as we witnessed a decrease in home prices for the first time in a decade. The most recent CoreLogic report states that Portland experienced a negative 0.7% decrease in home prices. Although this wasn’t exactly what we anticipated, we believe it’s important to keep this development in perspective. The market had become somewhat overheated during the recent boom, and this correction appears to be bringing it back to a more balanced state. While some sellers, especially condo owners, may have been affected, overall, it’s not a cause for alarm.

Sales Volume:

We accurately foresaw a decrease in sales volume, primarily driven by the rise in interest rates dissuading homeowners from upgrading. The reality is that sales volume decreased by 26.2% year over year, with new listings dropping by 18%. This decline in sales volume, as we predicted, has significantly influenced market dynamics. We eagerly await how the market will evolve in the coming year, given these trends.

Inventory:

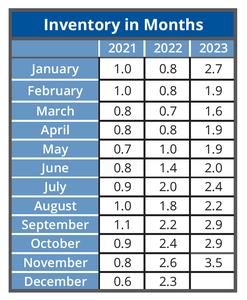

The decrease in sales volume naturally led to higher inventory levels. Presently, the Portland metro area boasts a 3.5-month inventory – the highest we’ve seen in years. Interestingly, this increased inventory hasn’t been as noticeable to buyers as one might expect. The market still retains signs of a seller’s market, albeit with properties spending more time on the market and, in some cases, more concessions from sellers. While we didn’t anticipate such a substantial increase in inventory, we did correctly predict the market’s shift toward a more balanced state.

Conclusion:

In retrospect, our 2023 predictions have been fairly accurate, with a few unexpected developments. Interest rates have remained stable, home prices saw a slight decline, sales volume decreased as expected, and inventory levels increased more than we initially anticipated. These predictions are a testament to our team’s ability to analyze past trends and consider current conditions to provide valuable guidance to both buyers and sellers navigating the ever-changing real estate landscape.

As we eagerly anticipate 2024, we look forward to continuing to provide insights that help you make informed decisions in the real estate market. Remember to stay tuned for our upcoming predictions – because when it comes to real estate, experience and expertise truly matter. Thank you for joining us on this journey.

Please check out the video our team put together covering our early 2023 predictions and the analysis: