Mortgage forbearance—it’s a term that gained prominence during the pandemic, but did you know it’s still a vital option for homeowners today? With recent shifts in the housing landscape and natural disasters making headlines, understanding forbearance and its role in providing relief is more important than ever.

What is Mortgage Forbearance?

Mortgage forbearance is a financial option that allows homeowners to temporarily pause or reduce their mortgage payments during a short-term financial crisis. It’s designed to provide breathing room for those facing unexpected hardships such as job loss, medical emergencies, or natural disasters. As explained by financial experts, forbearance gives homeowners the chance to sort out their finances and regain stability without falling behind on payments or risking foreclosure.

Misconceptions About Forbearance

Many people believe that forbearance was a tool specific to the COVID-19 pandemic. While it certainly garnered significant attention during that time, forbearance has been a longstanding resource available to homeowners in need. Even today, it remains an essential safety net for those experiencing financial strain.

Current Trends in Forbearance Rates

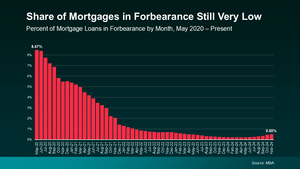

According to the Mortgage Bankers Association, mortgage forbearance rates have seen a slight but consistent increase in recent months. While these upticks are subtle compared to the dramatic spikes during the pandemic, they highlight a growing need for financial support among certain homeowners.

One of the key drivers of this increase is the impact of natural disasters. For example, hurricanes in the southern United States and wildfires in California have left many struggling to keep up with mortgage payments. In fact, 46% of borrowers currently in forbearance have cited natural disasters as the primary reason for their financial difficulties.

The Importance of Perspective

Despite the recent rise in forbearance rates, it’s essential to maintain perspective. Today’s rates are nowhere near the levels seen during the pandemic. More importantly, forbearance continues to serve its intended purpose: helping homeowners navigate temporary challenges and avoid foreclosure. This option provides critical support for those who need it most, helping them safeguard their homes and peace of mind.

How to Apply for Mortgage Forbearance

For homeowners facing financial difficulties, the process of applying for forbearance begins with contacting their mortgage lender. Lenders will guide applicants through the process, explain the terms, and determine eligibility. It’s crucial to remember that forbearance isn’t automatic—you must proactively apply and collaborate with your lender to find the best solution.

A Tool for Tough Times

Mortgage forbearance isn’t just a financial tool—it’s a means to protect your home and maintain peace of mind during challenging times. Whether you’re directly affected or know someone who is, understanding this option can make all the difference. In times of uncertainty, knowing your options is key to navigating hardships successfully.

If you or someone you know is facing financial stress related to mortgage payments, don’t hesitate to reach out to a trusted real estate professional or financial advisor for guidance. Protecting your home is about more than finances—it’s about securing your future.

Join Michele and Jackie on this week’s market update video as this discuss this topic more in depth: