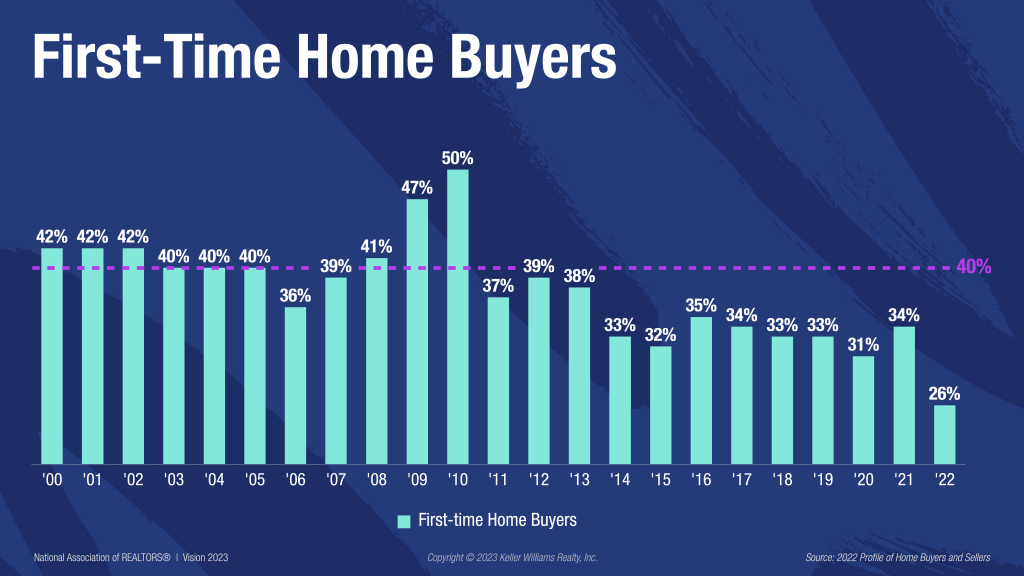

The idea of owning a home has been a long-standing American dream for many generations. However, millennials are not following this traditional path as fewer of them are buying homes than previous generations. According to a reports by the National Association of Realtors (NAR), millennials are buying homes at a lower rate than previous generations at the same age. In this blog, and video below, we will discuss why fewer millennials are buying real estate and address a few misconceptions that might be holding them back.

Outstanding Debt

One reason why millennials are not buying homes is that they are burdened with student loan debt. Many millennials are graduating from college with high levels of debt, making it more difficult to save for a down payment. According to another study by the National Association of Realtors, 83% of millennials say student loan debt is delaying their ability to buy a home.

Misconception 1

One common misconception that may be holding millennials back from buying homes is the idea that their first home needs to be their forever home. This is not the case. In fact, most people move several times before settling down in their “forever” home. It is important to buy a home that meets your current needs and can be easily resold or rented out in the future.

Misconception 2

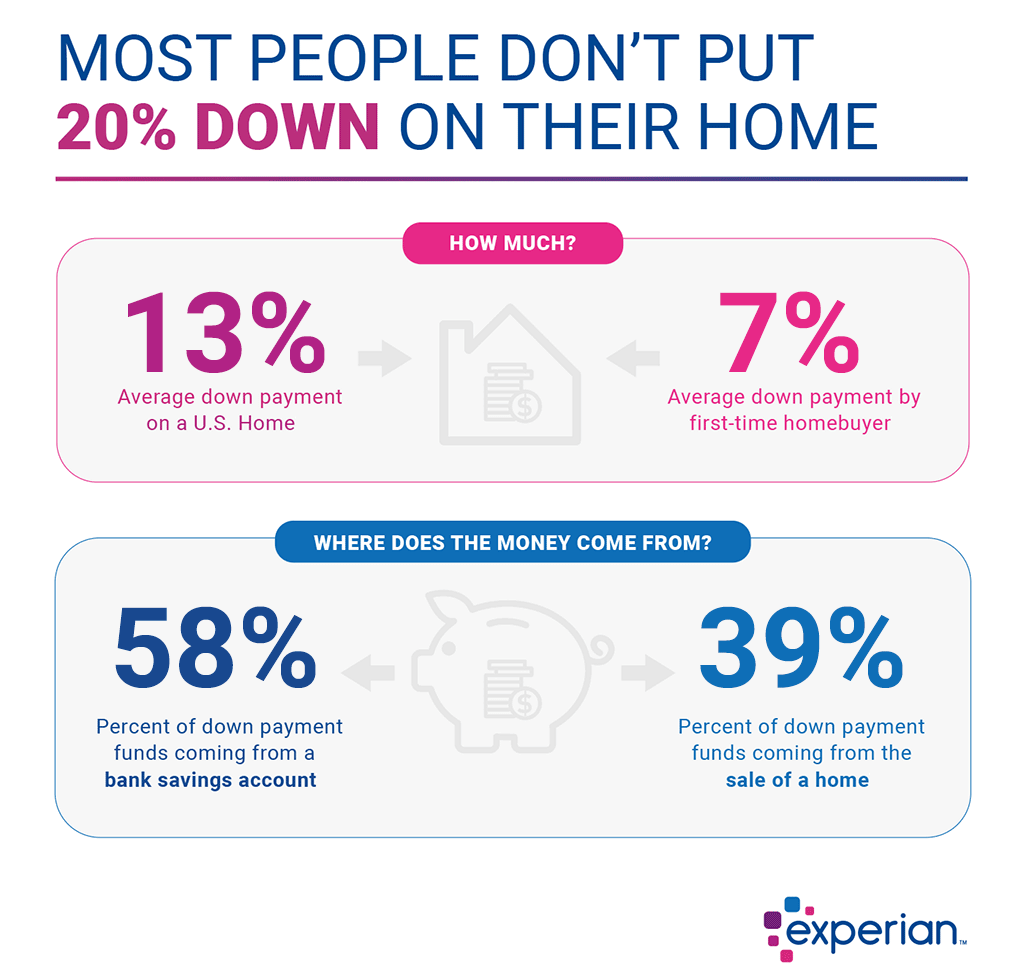

Another misconception is that you need to put 20% down payment on a home. While it is true that a larger down payment can help lower your monthly mortgage payments and interest rates, it is not necessary to put down 20%. The average down payment for a home in 2021 was 7%, according to the National Association of Realtors. There are also programs available, such as FHA loans, that require as little as 3.5% down payment.

Different Priorities

The last main reason why millennials are not buying homes, that we do not mention in the video, is because they have different priorities. Unlike previous generations, millennials are more focused on experiences rather than possessions. They prioritize traveling, education, and entrepreneurship, and are less concerned with settling down in one place. Many millennials are delaying marriage and starting a family, which are two common reasons why people buy homes. Additionally, millennials are more likely to live in urban areas where the cost of living is higher, making it more difficult to save for a down payment.

Conclusion

In conclusion, there are several reasons why fewer millennials are buying real estate than previous generations. Some of the main factors include different priorities, student loan debt, and the cost of living in urban areas. However, it is important to remember that buying a home is not a one-size-fits-all decision. Millennials should prioritize their own needs and financial situation when deciding whether or not to buy a home. Additionally, they should be aware of common misconceptions, such as the idea that your first home needs to be your forever home and the belief that a 20% down payment is necessary. By understanding these factors and misconceptions, millennials can make informed decisions about their housing choices.

We are not financial advisors, but we do know real estate very well. And we know that real estate is the more tried and true way to build wealth throughout your life and if that is something that you are interested in please reach out to us!