When considering the purchase or sale of a home, many people fixate on the idea of “timing the market.” They aim to buy at the lowest possible price or sell at the highest peak. However, this approach often leads to missed opportunities and increased stress. Instead, focusing on “time in the market” proves to be a more reliable strategy for long-term success.

The Myth of Perfect Timing

The concept of timing the market revolves around predicting future market conditions to make a transaction at the most advantageous moment. While it sounds logical, it’s incredibly challenging to execute. Market conditions are influenced by a myriad of unpredictable factors, making precise predictions nearly impossible.

Over the past few years, many potential homebuyers delayed their purchases, waiting for interest rates to drop. Unfortunately, the expected decline in interest rates didn’t materialize, and affordability hasn’t improved significantly. This highlights the inherent risk in trying to time the market. Instead of waiting for the perfect moment, a more pragmatic approach is to focus on entering the market when it aligns with personal and financial readiness.

Personal Factors Over Market Predictions

The decision to buy or sell a home should be primarily driven by individual circumstances rather than market speculation. Factors such as career stability, family needs, and financial health play crucial roles in determining the right time to enter the real estate market. It’s essential to assess personal goals and how they fit within the current market conditions.

For first-time homebuyers, the objective shouldn’t be to find a forever home immediately. The initial goal is to get a foothold in the market, build equity, and use that as leverage for future upgrades. Real estate should be viewed as a long-term investment, with the understanding that the right time to buy is when you are financially prepared and able to sustain homeownership for an extended period.

The Value of Time in the Market

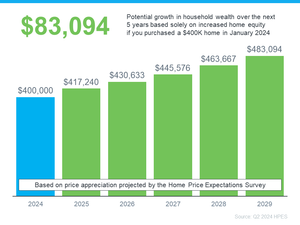

One of the most compelling reasons to prioritize time in the market over timing the market is the potential for equity growth. Real estate generally appreciates over time, providing homeowners with increased equity. For instance, modest investments in real estate over five years can yield significant returns. A modest example shows that buying a home now could potentially lead to around $85,000 in equity in just five years. This growth underscores the value of being in the market rather than waiting for the ideal buying conditions.

Renting vs. Owning

Many individuals and families find themselves renting for longer periods than initially planned. During this time, they miss out on the opportunity to build equity and benefit from the appreciation of real estate. Instead of viewing renting as a temporary solution, consider whether the time spent renting could be better utilized in owning a home. Even if it’s not the dream home, entering the market can provide a financial foundation for future property investments.

Making the Decision

Ultimately, the decision to buy or sell a home should be based on personal readiness rather than market speculation. The goal is to make a decision that aligns with individual needs and circumstances. It’s important to seek guidance and advice to understand how personal goals can be achieved within the current market conditions.

In conclusion, while the idea of timing the market is enticing, it is often fraught with uncertainty and missed opportunities. Focusing on time in the market allows for equity growth and a more stable investment trajectory. Assess personal and financial readiness, enter the market when it aligns with individual goals, and let time work in favor of real estate investment.

Watch the latest Monday Market Update video on the Hatch Homes Youtube Channel to learn more.